On Friday, Hudson Realty Capital announced the launch of a new bridge to HUD loan program for multifamily projects. This program is designed for market-rate, affordable, and senior housing investments and will focus on middle-market transactions involving acquisition, construction, stabilization, and rehabilitation.

The New York City-based lender has set a goal of lending $800 million through this bridge program in the next 36 months. The program is specifically tailored for property owners who are seeking permanent HUD financing but need assistance stabilizing their operations. One notable feature of this product is its enhanced flexibility – loans can be fully prepaid with no lockout period.

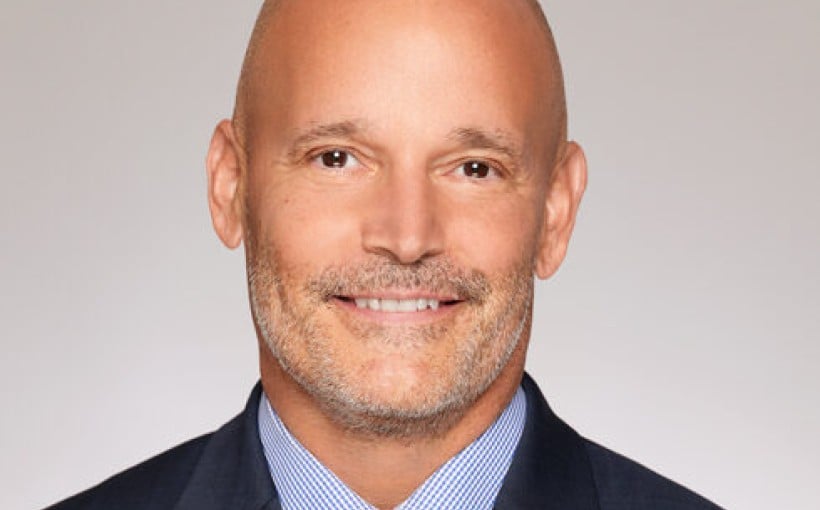

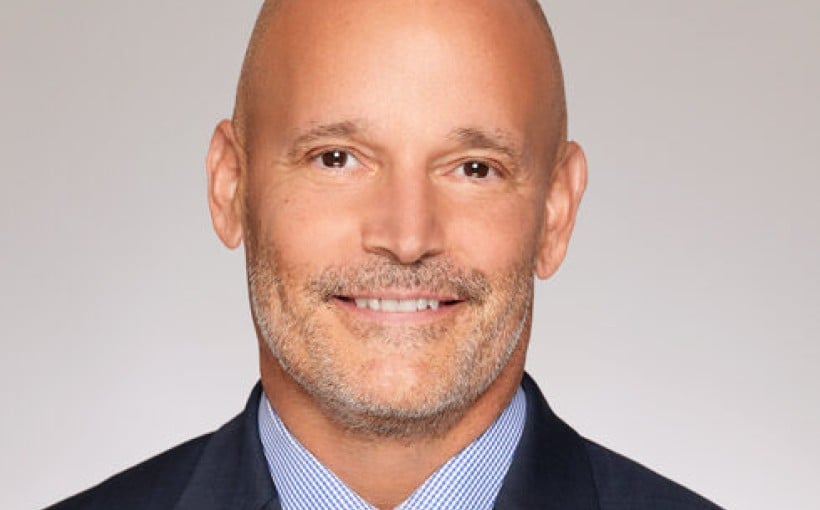

According to co-managing partner Rich Ortiz: “We are excited to expand our multifamily bridge loan offerings and provide our clients with a competitive and flexible path towards achieving their investment goals during these uncertain times in the lending industry.” He also added that this product will allow multifamily owners to access additional capital while positioning themselves favorably as they wait for long-term financing options to return to the market.

This announcement was originally published by Connect CRE.

“}]]