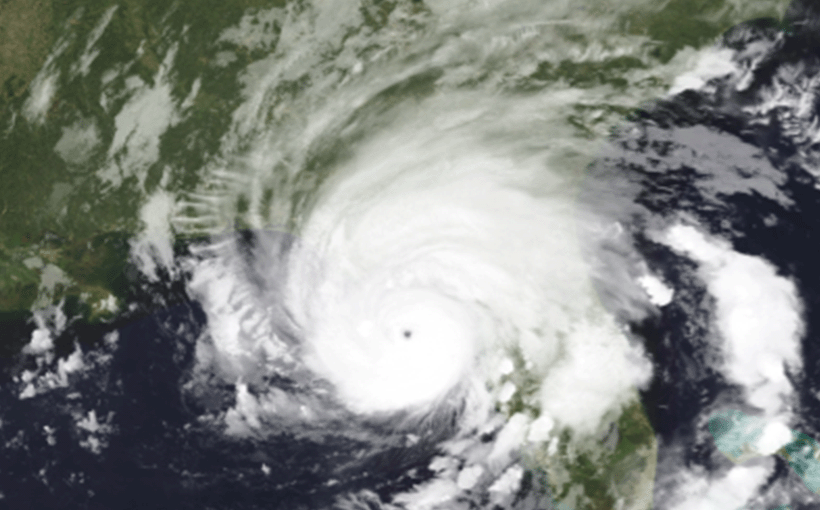

Owners of multifamily properties in Florida are facing increased insurance premiums due to Category 3 Hurricane Idalia hitting the Gulf Coast last month. The state, which has more hurricanes than any other, saw multifamily property insurance rates climb between 30 to 70 percent in 2023 following Hurricane Ian’s $53 billion in insured damages the year prior. Rates have become even higher for policy holders with prior losses, non-renewing carriers or valuation issues.

Multifamily sector is bearing the brunt of these rising costs as they typically consist of wood-frame structures with a higher potential for damage and high tenancy rates that generate more claims. Furthermore, it is becoming increasingly difficult to find coverage as fewer insurers are willing to underwrite policies and many firms have pulled out from Florida due its riskiness associated with heavy losses.